Dec 14, 2022While a corporation is a type of business entity, an S-corp is a tax designation available to certain corporations and LLCs. S-corps are named from the subchapter of the Internal Revenue Code

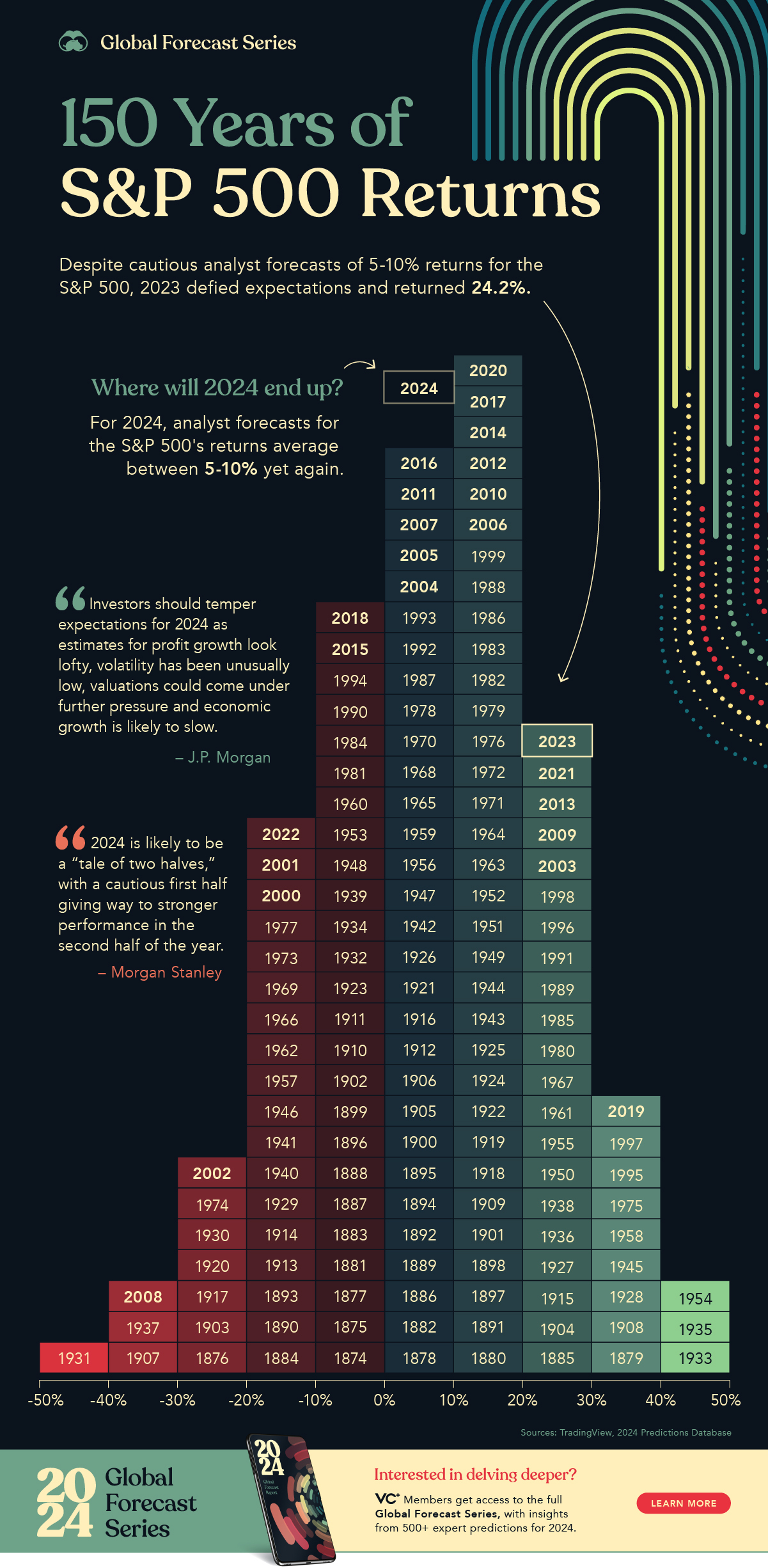

Visualizing 150 Years of S&P 500 Returns

Dec 13, 2023The most accurate statement about S corporations is that they are attractive because they avoid double taxation, allowing income to be taxed only at the shareholder level. Therefore, correct option is a. Explanation: The most accurate statement about S corporations is that a. The major attraction of S corporations is that they avoid the problem

Source Image: justonecookbook.com

Download Image

Questions and Answers for [Solved] Which of the following statements about S corporations is MOST accurate? A)S corporations enable owners to avoid the problem of double taxation. B)S corporations can have an unlimited number of owners. C)S corporations must have fewer than 5 employees. D)S corporation are easier to set up than sole proprietorships and partnerships.

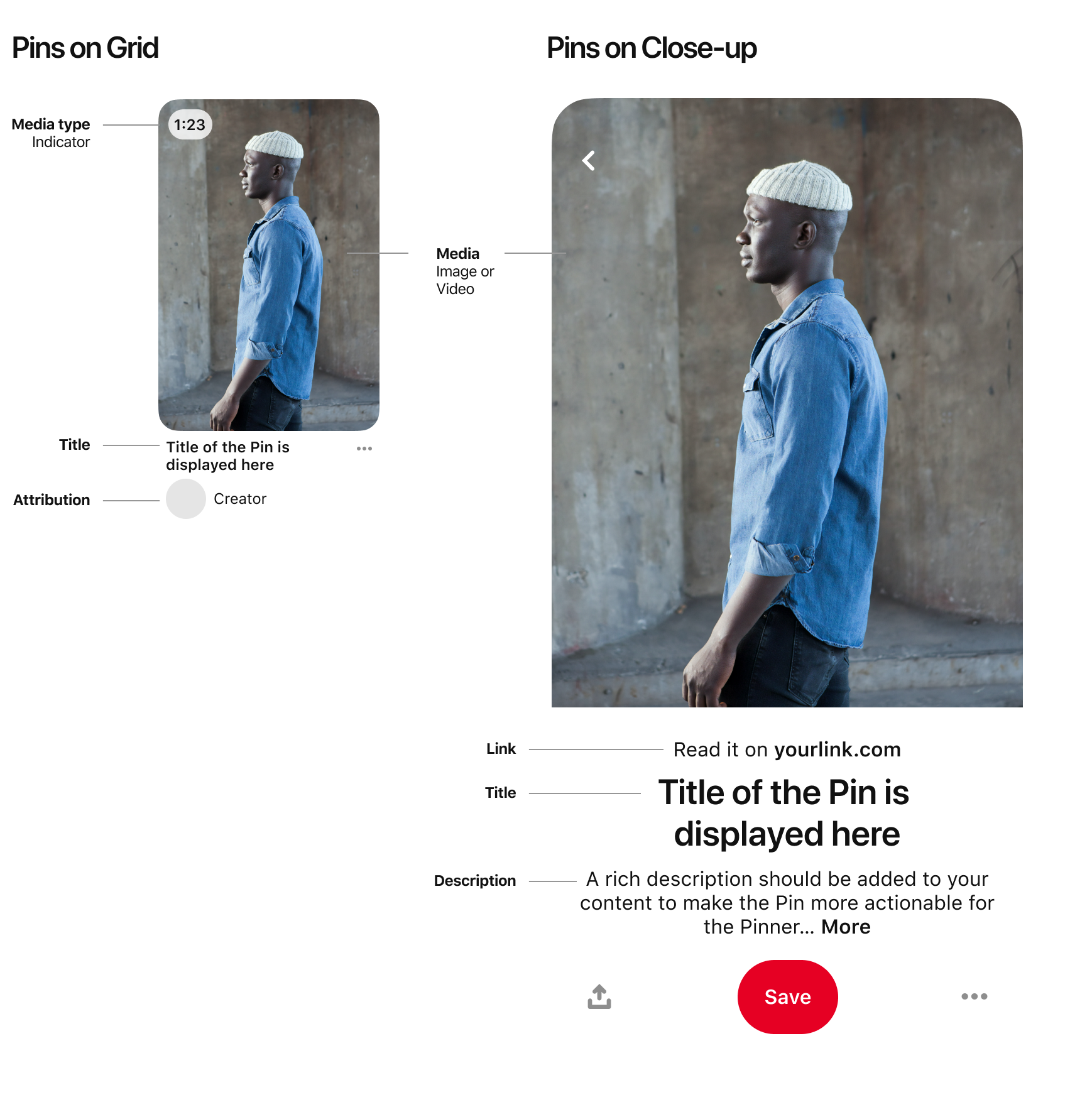

Source Image: help.pinterest.com

Download Image

42 Pinterest Stats That Matter to Marketers in 2024 About Pinterest. Pinterest is the visual inspiration platform where people come to search, save, and shop the best ideas in the world for all of life’s moments. Whether it’s planning an outfit, trying a new beauty ritual, renovating a home, or discovering a new recipe, Pinterest is the best place to confidently go from inspiration to action.

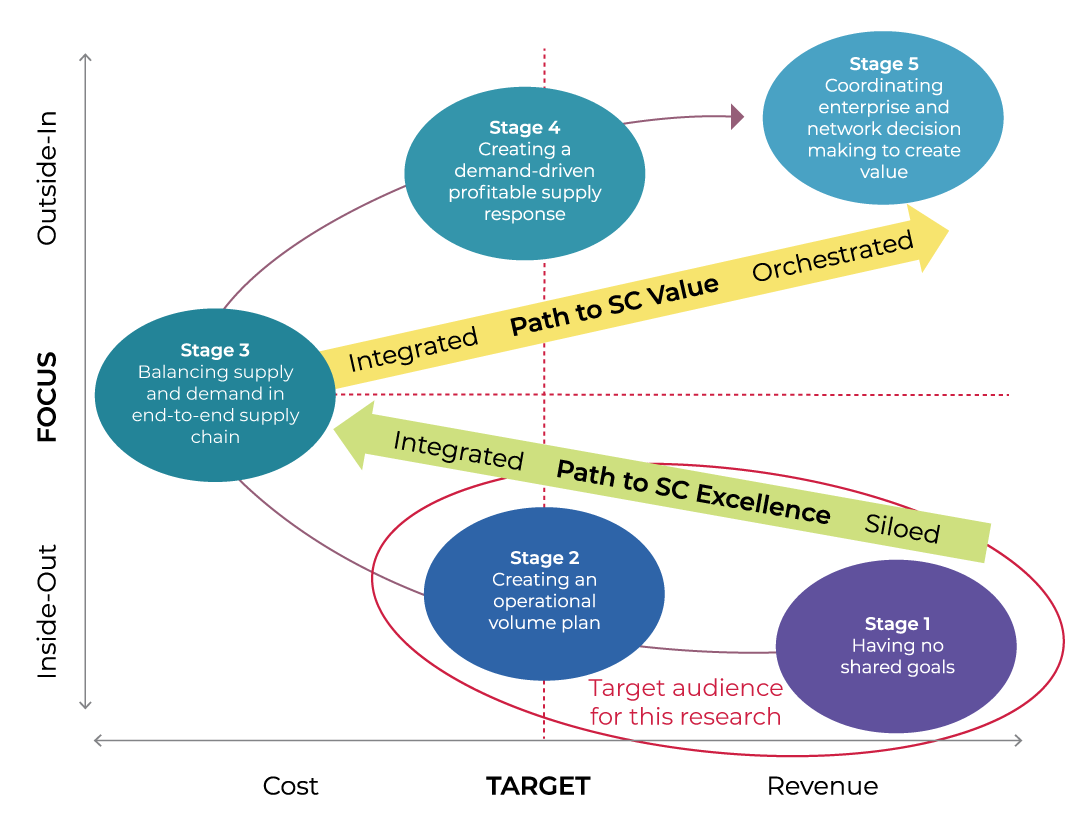

Source Image: blog.arkieva.com

Download Image

Which Statement About S Corporations Is Most Accurate

About Pinterest. Pinterest is the visual inspiration platform where people come to search, save, and shop the best ideas in the world for all of life’s moments. Whether it’s planning an outfit, trying a new beauty ritual, renovating a home, or discovering a new recipe, Pinterest is the best place to confidently go from inspiration to action. a. The major attraction of S corporations is that they avoid the problem of double taxation. b. S Corporations are similar to C corporations, except that the majority of owners are foreign investors. c. Any corporation willing to pay the necessary fees and fill out the required paperwork can become an S Corporation.

Sales & Operational Planning (S&OP) Versus Integrated Business Planning (IBP)

a) Any corporation willing to pay the necessary fees and fill out the required paperwork can become an S Corporation. b) Only large corporations with operations in more than one state can qualify to be classified as S corporations. c) S Corporations are similar to C corporations, except that the majority of owners are foreign investors. d) The Is Becoming a Surgical Tech Worth it? 6 Points to Consider | Rasmussen University

Source Image: rasmussen.edu

Download Image

Guide to Corporations: Definition and Types (2023) – Shopify a) Any corporation willing to pay the necessary fees and fill out the required paperwork can become an S Corporation. b) Only large corporations with operations in more than one state can qualify to be classified as S corporations. c) S Corporations are similar to C corporations, except that the majority of owners are foreign investors. d) The

Source Image: shopify.com

Download Image

Visualizing 150 Years of S&P 500 Returns Dec 14, 2022While a corporation is a type of business entity, an S-corp is a tax designation available to certain corporations and LLCs. S-corps are named from the subchapter of the Internal Revenue Code

Source Image: visualcapitalist.com

Download Image

42 Pinterest Stats That Matter to Marketers in 2024 Questions and Answers for [Solved] Which of the following statements about S corporations is MOST accurate? A)S corporations enable owners to avoid the problem of double taxation. B)S corporations can have an unlimited number of owners. C)S corporations must have fewer than 5 employees. D)S corporation are easier to set up than sole proprietorships and partnerships.

Source Image: blog.hootsuite.com

Download Image

Yakisoba (Japanese Stir-Fried Noodles)(Video) 焼きそば • Just One Cookbook A) The major attraction of S corporations is that they avoid the problem of double taxation. B) S Corporations are similar to C corporations, except that the majority of owners are foreign investors. C) Any corporation willing to pay the necessary fees and fill out the required paperwork can become an S Corporation. D) Only large corporations

Source Image: justonecookbook.com

Download Image

Research: Social Shopping in 2022 | Sprout Social About Pinterest. Pinterest is the visual inspiration platform where people come to search, save, and shop the best ideas in the world for all of life’s moments. Whether it’s planning an outfit, trying a new beauty ritual, renovating a home, or discovering a new recipe, Pinterest is the best place to confidently go from inspiration to action.

Source Image: sproutsocial.com

Download Image

17 Types of Reports for Reporting and Decision Making – Venngage a. The major attraction of S corporations is that they avoid the problem of double taxation. b. S Corporations are similar to C corporations, except that the majority of owners are foreign investors. c. Any corporation willing to pay the necessary fees and fill out the required paperwork can become an S Corporation.

Source Image: venngage.com

Download Image

Guide to Corporations: Definition and Types (2023) – Shopify

17 Types of Reports for Reporting and Decision Making – Venngage Dec 13, 2023The most accurate statement about S corporations is that they are attractive because they avoid double taxation, allowing income to be taxed only at the shareholder level. Therefore, correct option is a. Explanation: The most accurate statement about S corporations is that a. The major attraction of S corporations is that they avoid the problem

42 Pinterest Stats That Matter to Marketers in 2024 Research: Social Shopping in 2022 | Sprout Social A) The major attraction of S corporations is that they avoid the problem of double taxation. B) S Corporations are similar to C corporations, except that the majority of owners are foreign investors. C) Any corporation willing to pay the necessary fees and fill out the required paperwork can become an S Corporation. D) Only large corporations